With 2019 behind us, we would like to provide you with our forward-looking thoughts on new demand drivers for 2020. These eight drivers below do not encompass all the potential demand drivers for passive components. The AR (augmented reality) movement is one to keep an eye on, but rumors out of Magic Leap say they have sold only 6,000 headsets compared to 100,000 the CEO wanted to sell (1). If Apple introduces an AR headset, it will be a gamechanger for this space. 2020 is going to be the year of 5G, and the widespread adoption of Industry 4.0 (4th Industrial Revolution). Here are Venkel’s top eight growth demand drivers for 2020:

Smartphones

Smartphone demand is still incredibly strong even though the market has reached a saturation point. The upgrade cycle for Android and iOS phones is about to kick in big time with the introduction of 5G phones and improved cameras (i.e. the iPhone 11 Pro with 3 camera sensors). During this year’s Consumer Electronic Show (CES) in Las Vegas, the president of Qualcomm said that there will be over 200 million 5G smartphones sold this year. Also, that he expects that 2020 will be the year that 5G finally scales (13).

Smartphone demand over the next 4 years is expected to average around 1.4 Billion devices sold per year, according to IDC (International Data Corporation) (2). This demand includes Android and iOS devices. This doesn’t consider any tablets. According to our research, the iPhone X has around 1,000 MLCCs (multilayer ceramic capacitors) per device, and an average Android has around 700 MLCCs per device. If we use the projections that IDC has on the amount of Android and iOS devices sold, the smartphone industry roughly consumes around 1 Trillion MLCCs per year! This segment is the largest consumer of MLCCs in the world. When the smartphone industry projects increase or decrease, the ripple effects of this supply shortage or glut can be felt. A 10% fluctuation equates to roughly 100 billion MLCCs. The industry cannot absorb this kind of demand so that is why we see some parts go into allocation or surplus based on this.

|

Related Resource Snapshot - Demand Drivers for Passive Components in 2020 |

|

Artificial Intelligence Accelerators

AI Accelerators are specifically designed semiconductors, FPGAs or ASICs that create hardware acceleration for artificial intelligence applications, especially neural networks, machine vision and machine learning. These devices sit inside servers/personal computers via a PCI or are tethered to them via USB. For example, Google advertises that each Accelerator utilizing their Tensor Processor Unit (TPU) can process 1 million photos per second (3).

The AI Accelerator is a relatively new type of hardware that first came into play about three to four years ago with little fanfare. But now, these accelerators are in high demand thanks to the approval/adoptions of the Edge Computing concept. There are now over 45 startups focusing exclusively on these accelerators, either with hardware and/or software. Some like Graphcore and Cerebras have each raised more the $100 million to prove that their technology can be used to better execute AI functions. Hebana, an AI accelerator developer that focused on programmable chips for the data center, just got bought for $2 billion by Intel in mid-December 2019. Intel estimates that the TAM for AI silicon will be greater than $25 billion by 2024 (4).

Google, NVIDIA, AMD, Amazon and the aforementioned Intel are all working on these devices as well. These companies believe that these AI chipsets will give their products and/or services a competitive advantage over their competition.

How does this effect the demand of components going into 2020? In 2016, it was reported that Amazon Web Services had around 1.3 million servers and Google had around 2.5 million servers. If every server is going to get an AI Accelerator, that is at least 3.8 million chip sets alone for just Amazon and Google. Microsoft, NVIDIA, IBM, and Google all have their own Cloud hosting. Not to mention Facebook builds their own hardware/infrastructure as well. All these platforms will benefit from these devices. If each chipset has around 100-200 MLCCs (low estimate given how much computing power and memory these have) and there are 10 million servers that need these chips, that equates to 1-2 billion MLCCs

Automotive – Conventional Combustion Engine Cars and Hybrids

The demand for passive components in cars is about to increase exponentially. We are starting to see more electronics in each car that is being produced. All types of cars are getting smarter via the Advanced Driver Assistance Systems (ADAS) and autonomous vehicle adoption. According to Murata, here is a current breakdown of the number of MLCCs and Inductors per car (5):

|

|

Conventional Cars (Ford F-150) |

Hybrid (Toyota Prius) |

Full Electric Vehicle (Tesla) |

|

MLCCs (pcs) |

3,000 |

6,000 |

10,000 |

|

Inductors (pcs) |

300 |

600 |

600 |

|

MLCCs per |

Conventional (Ford F-150) |

Mild Hybrid (Toyota Camry) |

Full Hybrid (Toyota Prius) |

Plug-In Hybrid (Chevy Volt) |

Battery Hybrid (Tesla) |

|

Powertrain |

300 to 500 |

1,000 to 2,000 |

1,200 to 1,600 |

1,500 to 2,000 |

2,000 to 2,500 |

|

ADAS |

2,000 to 3,000 |

||||

|

Safety |

300 to 1,000 |

||||

|

Non-Safety |

500 to 2,500 |

||||

|

Infotainment |

500 – 2,500 |

||||

Source: Murata Information Meeting 2019 (5)

The MLCC count is only going to increase as cars get more advanced. The big trend for cars is going to be the “Connected” Car which will be able to communicate with other cars on the road, the infrastructure (i.e. lights) and with people on the road. Soon, you will be able to get an alert of a speeding car coming down an intersection on your phone that is dependent on your physical location. All these advancements require passive components, especially MLCCs and inductors.

The ADAS boom is already here with the proliferation of backup cameras, tire pressure monitors, remote start, remote diagnostics and blind spot monitors. All of this gadgetry requires more passive components. You can see above that the ADAS components take up a majority of the MLCCs per car, and evidence suggests this number will only increase as more cars slowly start getting some “autonomous” features like self-park and summon (current feature in Tesla’s).

In 2018, there were roughly 80.6 million cars sold worldwide, and in 2019, it is estimated at 77.5 million cars sold. For 2020, the global projection is set to be 78 million cars (6). Even though the number of cars being sold is decreasing, there is a large increase in the amount of electronics per new car. Because of this uptick, we believe the market for automotive MLCCs is going to expand tremendously. Morgan Stanley projects the TAM of all types of MLCCs could increase by 19-28% from 2020 to 2021. This could explain why Murata and TDK have de-emphasized thousands of commercial grade MLCCs and are expanding their automotive lines. The projected MLCC demand based on 78 million cars X 4,000 MLCCs (averaging Conventional with Hybrid) will be roughly 312 billion MLCCs just for 2020.

Electric Vehicles & Electric Bikes

In 2018, there were 1.6 million electric vehicles sold. It is projected that number will go up to 12 million EVs sold per year by 2025, according to Deloitte (7). If each EV averages around 10,000 MLCCs, that will be roughly 120 billion MLCCs per year alone on EVs, by 2025.

Electric bikes or e-bikes are expected to be in high demand due to massive market penetration in Asia and Europe. In 2013, there were 32 million e-bikes sold throughout the world. Between now and 2023, Deloitte is projecting there are going to be 130 million bikes sold! E-bikes, unlike EVs, do not require any specialized plug or in home system. These can be charged via a typical wall outlet. The demand for these are increasing as more and more people around the world relocate into modern cities. The largest shift in populations moving is occurring in Asia. There isn’t much room for more cars and/or parking lots so people are adopting e-bikes at very high rate. The cost per bike is also going down with the increase in scale and lower cost of lithium batteries. Based upon the Xiaomi MiJia bike 2017 model, each e-bike will have over 55 MLCCs and over 100 resistors.

Consumer Internet of Things

We have finally achieved a mass adoption of the Internet of Things (IoT). We have been hearing about it since 2015, but it has taken time to get the IoT infrastructure in place. By IoT, we mean any device that is connected to the internet or an intranet via wireless or wired connection. Common examples are Google Home, Amazon Alexa, Nest thermostat and smart doorbells. Most of these devices are powered by a SoC (System on Chip). According to our research, most of these devices have around 50 MLCCs per. An Amazon Alexa Dot has over 75 MLCCs per. Amazon has sold more than 100 million devices as of January 2019.

26 billion IoT devices are currently connected in the world. This number is expected to reach 75 billion by 2025 (8). That is roughly 10 billion new IoT devices added each year for the next 5 years. If each device has a similar component count to the Amazon Alexa Dot, IoT could end up consuming 1 trillion MLCCs per year! Smartphone and IoT combined are projected to use over 2 trillion MLCCs per year.

Industrial Automation or Industrial Internet of Things (IIoT)

This is being discussed also as Industry 4.0 or the 4th industrial revolution. What does this mean exactly? It is a convergence of big data analytics, high end servers, edge computing, AI, machine to machine (M2M) devices and sensors. The example I like to use is imagine if a large-scale farming operation has over 5,000 acres. Each crop area could have a dozen or so moisture sensors that communicate with a wireless base station. When the moisture drops to a certain level, it kicks of the irrigation system and/or delivers nutrients based on the PH levels. It provides the farmer a higher level of comfort and reduces the physical amount of time someone has to inspect. This system would also be performing real time analysis on crop conditions and weather patterns to ensure efficiencies.

There are factories all over the world already utilizing connected sensors to monitor their process. Rockwell Automation is investing in this space with their FactoryTalk line. These sensors provide a machine operator or plant manager with historical data on how well certain machines or processes are working as well as where/when exactly a fault has occurred.

Real time analytics are going to get supercharged by 5G and Edge computing in terms of “big data” analyzing large scale operations more efficiently. Companies could start deploying their own 5G small cells, instead of WiFi or ZigBee.

It is too early in the stage to predict MLCC and Resistor consumption, but it will be very significant.

5G Infrastructure/Modems/Backend Equipment

The build out of the 5G infrastructure is going to be the catalyst for smartphone demand, IIoT, IoT and Autonomous Vehicles. Without this technology, Industry 4.0 will not be able to operate. This is because with 5G comes increased bandwidth and lower latency. Lower latency is key for the autonomous vehicles ability to communicate with surrounding cars, city infrastructure and sensors to communicate what is a life form. Edge computing will also require the speed of 5G in order to process certain aspects of the autonomous vehicles’ functions.

There is a big difference between 4G LTE and 5G, in terms of base station density. There are about 20-25 per square mile for 4G. Whereas, the 5G base stations there might need to be 100-125 per square mile (9). Also, line of sight is key to achieving the high speeds with 5G. Because of this technological difference, telecom companies will have to install more base stations in a city or rural area. China apparently has already deployed over 100,000 5G base stations during their “testing” period. According to a Politico article (10), the USA will deploy 800,000 base stations by 2026. Based on our research and intelligence, the 5G base station has roughly 15,000 MLCCs and 10,000 resistors per device. This is around a 2-3 times increase over the 4G base station. The reason for this increase is the 5G device is 16 channels by 16 channels, and a 4G base station is 4 channels by 4 channels. You are increasing the bandwidth 4 times.

Imagine each lamppost downtown in your city having a 5G base station on it in order to take advantage of the increased speed of the network. AT&T, Sprint, T-Mobile and Verizon are all deploying their 5G base stations throughout the USA. The base station demand is just starting to ramp up. These base stations have large case size (0805, 1210 and 2220) capacitors as well as high voltage, High-Q NP0 and “popcorn” (0.1uF or less/50V or less) MLCCs. Large case size MLCCs could be impacted by the roll out because manufacturers cannot achieve, for example, a 4.7uF, 100V, X7R in anything smaller than a 1210. Parts like this will always be in demand, do not be concerned that these larger size parts will be obsoleted.

Verizon is the first telecom to offer an in home 5G modem for consumers. It’s offering is packed with features like Amazon Alexa, 10W speaker, Bluetooth playback and Wi-Fi 6 (12). We expect that demand for the in home 5G modem will increase rapidly once the rollout is more widespread. The potential is for each home to have one of these instead of cable or fiber modem. Like everything with 5G, these modems will most likely require more passives to handle the increased bandwidth and power requirements.

With the 5G infrastructure build up comes investment in the network’s back office as well. According to McKinssey, the entire infrastructure of these telecoms must be upgraded in order to effectively deploy 5G to a city or area (11). The industry is going to see demand for 5G base stations, 5G Modems (vehicle, machine to machine (M2M), home or business) and 5G test and measurement equipment. For the most part, everything has to be new in order to take advantage of the speed.

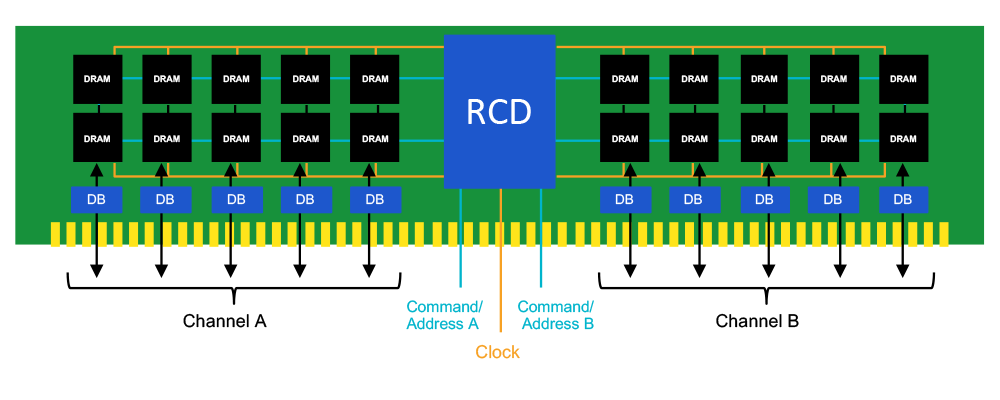

DDR5 Memory Modules

Based on our research, DDR5 will begin to slowly trickle out towards the end of 2020. Adoption rate will be slow at first, but it should ramp up very quickly especially on the server side starting in 2021. Our sources project that DDR5 will require about 10-15% more MLCCs per module. While it won’t affect passive component demand in 2020, we believe DDR5 will be a significant consumer of passive components in 2021 and beyond.

So what does all this mean?

To help put all this information into perspective and to summarize our conclusions, based on our research we believe the total combined annual capacity of all MLCC manufacturers worldwide to be around 4.5 Trillion pieces. In our estimation, just the 8 sectors mentioned above will utilize approximately 3.3 Trillion pieces or roughly 73% of capacity, leaving 27% for everything else!

So, is the industry going to go back to the shortage/allocation days like in 2018? – maybe, but most likely not as bad. That doesn’t mean you shouldn’t be doing things to prepare yourself or your company for what lies ahead. So what does lie ahead? Increased lead times, possible more Not Recommended for New Design (NRND) or End of Life (EOL) parts from the other manufacturers, tightening of availability for popular 5G parts (like the 0402, X7R, 0.1uF), and possibly more delays from IC manufacturers like Intel. Intel is struggling to keep up with demand right now for their chips. If you have the ability, I would recommend adding more sources to the AVL/Bill of Materials in case things really tighten up. If you can take care of something like this now, you don’t have to scramble later when availability tightens up.

Please know that this is our opinion of the 2020 market based on our own research and intelligence.

References:

- https://www.theinformation.com/articles/dented-reality-magic-leap-sees-slow-sales-steep-losses

- https://www.idc.com/getdoc.jsp?containerId=prUS45115119

- https://cloud.google.com/blog/products/ai-machine-learning/cloud-tpu-breaks-scalability-records-for-ai-inference

- https://newsroom.intel.com/news-releases/intel-ai-acquisition/#gs.q06r6c

- https://www.murata.com/-/media/webrenewal/about/newsroom/news/irnews/irnews/2019/1129/1911_e_speach.ashx?intcid5=com_xxx_xxx_hm_ms1_xxx&la=en-us

- https://www.forbes.com/sites/neilwinton/2019/12/05/global-auto-sales-will-slide-again-in-2020-but-china-rally-begins/#580b9efa53fe

- https://www2.deloitte.com/content/dam/insights/us/articles/722835_tmt-predictions-2020/DI_TMT-Prediction-2020.pdf

- https://ipropertymanagement.com/research/iot-statistics

- https://www.newtec.eu/article/article/choosing-the-right-connectivity-for-5g

- https://www.politico.com/news/2019/12/29/big-barrier-trump-5g-america-089883

- https://www.mckinsey.com/industries/technology-media-and-telecommunications/our-insights/the-road-to-5g-the-inevitable-growth-of-infrastructure-cost

- https://www.verizon.com/about/news/verizon-5g-home-internet-coming-chicago

- https://www.digitaltrends.com/mobile/5g-qualcomm-ces-fixed-wireless-lenovo/